Volta Grande

Belo Sun is developing the Volta Grande Project with the aim of generating sustainable long-term value for its shareholders and its host communities. Our Feasibility Study completed in March 2015 forecasts an open-pit mine with a long lifespan, strong production profile, bottom quartile operating costs, and robust economics.

The Volta Grande Project is situated in the Três Palmeiras greenstone belt in Pará State, Brazil. Although the project's mining license covers 2400 hectares (24 square kilometers), the actual area dedicated to the mining operation is much smaller, encompassing only about 10 square kilometers. This represents a minimal portion of the greenstone belt, which extends over 120 kilometers, underscoring our commitment to minimizing the environmental footprint.

The Project employs a comprehensive approach to sustainable development.

Our seasoned leadership team has extensive expertise in permitting, constructing, and operating mines in Latin America, particularly Brazil. Belo Sun is committed to being a conscientious steward of the Amazonian ecosystem within which it operates, and to being a trusted partner of the communities who reside there.

Our practices are designed to meet all local and international standards, including those set by the International Commission on Large Dams, the Canadian Dam Association, and the Mining Association of Canada.

Project Overview

The Volta Grande Project is situated in the Três Palmeiras greenstone belt in Pará State, Brazil. Although the project's mining license covers 2400 hectares (24 square kilometers), the actual area dedicated to the mining operation is much smaller, encompassing only about 10 square kilometers. This represents a minimal portion of the greenstone belt, which extends over 120 kilometers, underscoring our commitment to minimizing the environmental footprint. Despite the size of the concession, the current mining plan is intentionally designed to minimize the environmental impact of the project. This approach ensures that our operations, though part of a larger land package, will not significantly disturb the surrounding landscape, aligning with our commitment to sustainable and responsible mining practices.

The Volta Grande Project is located 60 kilometers southeast of the City of Altamira.

The Project will be powered through a connection to the Xingu Altamira Equatorial substation. This decision was made after considering various options, ensuring a reliable and consistent energy supply for Belo Sun Mineração's operations. In line with our commitment to environmental responsibility, all the Project’s water requirements will be met through a rain water capture and recycling system and process designed to ensure that no water will be taken from nor discharged into the Xingu River.

The region has a tropical climate. The rainy season spans from December to May, while the dry season lasts from June to November. The average temperature remains consistent throughout the year, ranging from 25°C to 30°C, and relative humidity varies from 65% to 85%.

Host Communities

At Belo Sun, we recognize that building on someone else’s land is a privilege, and we are committed to being good and trusted neighbors in the area where we operate. For over a decade, we have worked closely with our local communities, fostering relationships built on mutual respect, transparency, and our dedication to improving the social and economic well-being of our host communities. Each year, Belo Sun invests in community actions, supporting vital sectors such as health, education, and local associations, demonstrating our ongoing commitment to the community.

We have a multifaceted approach to community engagement. When we start building the Volta Grande Project, we will make local hiring and the use of local suppliers and supply chains a priority to ensure the local economy thrives alongside our project. Belo Sun will continue to contribute to local development by investing in vocational training, education, and healthcare facilities, recognizing that these are pillars of a robust and sustainable community. Furthermore, our commitment to environmental stewardship, particularly in safeguarding water levels and water quality in the Xingu River, is at the core of our plans to build and operate a responsible, safe, and modern mine that will minimize environmental risks, comply with all Brazilian laws and regulations, and be consistent with international best practices and standards. You can learn more about these initiatives in our on our local Community page, and in the Frequently Asked Questions section.

Because we value the views and opinions of our neighbors and want to ensure our operations align with their needs and aspirations, we have set up community information centers to facilitate regular communication and engagement.

Feasability Study Results

Our Feasibility Study, completed in March 2015, was not just about numbers but about balancing commercial viability with environmental sustainability and social responsibility. Here are some key data points:

-

Average annual gold production: 205,000 oz

-

Proven & Probable Mineral Reserves: 3.8 million oz

-

Post-Tax IRR: 26% ($1,200/oz Au)

-

Post-Tax NPV: $665 million (5% discount rate)

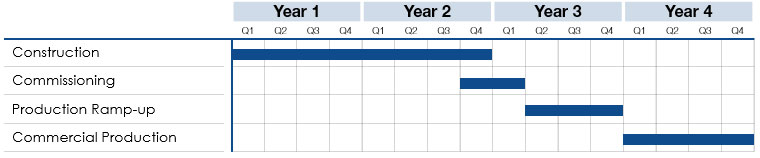

Estimated Project Construction Schedule

Mining

The Project's Feasibility Study outlines plans for open pit mining using a fully owner-operated equipment fleet. Initially, the mine is designed to produce 3.5 million tonnes per year, escalating to a full production of 7 million tonnes per year by the third year with a delivered head grade of 1.30 g/t. Material from the pre-production stripping’s last three months will commission the process plant.

Over the mine's lifetime, an average strip ratio of 4.3:1 is anticipated, with open pit bench heights of 10 meters. Ore will be hauled using 136-tonne haul trucks and corresponding loading equipment, maintaining a stockpile adjacent to the primary crushing plant to mitigate potential weather-related mining interruptions. Concurrently, waste rock will be transported to designated waste management facilities near the open pits, ensuring streamlined and environmentally conscious operations.

Metallurgy

Extensive feasibility-level test work completed by SGS using representative run-of-mine composites confirmed that the Volta Grande Project mineral deposits are suitable for a conventional crush, grind, gravity concentration, leach, and carbon-in-pulp (CIP) flow sheet.

These tests indicate that 40% to 50% of the gold will be recovered in a gravity concentrate, contributing to an overall estimated gold recovery of 93% from all ore types processed during the mine's lifespan. This efficient recovery rate optimizes the Project’s resources while safeguarding the surrounding environment.

Mineral Reserves

The mineral reserves for the Volta Grande Gold Project are based on the conversion of measured and indicated mineral resources (see Mineral Resources section) within the current Feasibility Study mine plan. Measured mineral resources are converted directly to Proven mineral reserves and Indicated mineral resources to Probable reserves. The total fully diluted mineral reserves for the Volta Grande Project are as follows:

| Classification | Tonnes(t) | Gold Grade g/t) | Contained Gold(oz) |

|---|---|---|---|

| Proven | 41,757,000 | 1.07 | 1,442,000 |

| Probable | 74,212,000 | 0.98 | 2,346,000 |

| Proven + Probable | 115,969,000 | 1.02 | 3,788,000 |

**The above information was obtained from the Feasibility Study report for the Volta Grande Gold Project, which can be downloaded here. Please see cautionary notes and Qualified Person statement related to these results here.

Mineral Resources

The Volta Grande Project's current mineral resources are divided into two areas: the North Block and the South Block. The North Block comprises four zones: Ouro Verde, Junction, Grota Seca, and Greia. The South Block is situated approximately 10 kilometers to the south-east. An updated mineral resource and reserve estimate for selected zones in the North Block were prepared by SRK Consulting in conjunction with the Feasibility Study during the first quarter of 2015, with the details listed below. The most recent mineral resource estimate for the South Block was prepared by SRK Consulting in March 2014. The associated technical report is accessible on Belo Sun’s profile at www.sedar.com.

Volta Grande Mineral Resources, March 2015

(North Block Area, including Ouro Verde, Junction, Grota Seca and Greia zones)

| Classification | Tonnes | Gold Grade (g/t) | Contained Gold (oz) |

|---|---|---|---|

| Measured | 44,080,000 | 1.07 | 1,512,000 |

| Indicated | 112,518,000 | 0.95 | 3,444,000 |

| Measured & Indicated | 156,593,000 | 0.98 | 4,956,000 |

| Inferred | 39,767,000 | 0.90 | 1,151,000 |

Volta Grande Project Tailings Management Facility

Future-Forward Commitment to Responsible Tailings Management

Belo Sun is laying the groundwork for the Volta Grande Project Tailings Management Facility, where the highest standards of safety and responsibility will be our guideposts.

Proposed Tailings Management Standards:

- Will comply with all Brazilian standards, aligning with the International Commission on Large Dams, the Canadian Dam Association, and the Mining Association of Canada.

- An Independent Tailings Review Board will oversee the design and construction, ensuring adherence to industry best practices and timely reporting to senior management and the Board of Directors.

Planned Maintenance and Monitoring:

- Regular inspections, instrumentation monitoring, and data analysis will be conducted.

- A comprehensive tailings scorecard will be implemented to maintain optimal management indicators.

- Annual inspections by the engineer of record, with independent expert reviews every three years.

Safety Assurance:

- The facility will be engineered to withstand significant storm and seismic events.

- Detailed emergency response and preparedness plans will be developed, including community-based emergency simulation training in collaboration with local authorities.

Strategic Closure Planning:

- Comprehensive plans for minimizing impounded water will be in place to enhance long-term safety and land-use value.

- The facility is designed for closure readiness at the end of mine life, ensuring enduring safety and compliance with all laws and regulations.

We’re planning for the safety, well-being, and prosperity of communities, the environment, and generations to come.

Growth Potential

Belo Sun's Exploration Concessions cover over 160,000 hectares within the Três Palmeiras greenstone belt in Brazil's northeastern state of Para. This area has been subject to small-scale mining activities since the 1960s, yet a significant portion of the greenstone belt, which stretches approximately 120 kilometers in length and varies from 1 to 8 kilometers in width, has not been extensively explored.

The South Block, a brownfield target within this area, hosts a mineral resource that warrants systematic drilling. To date, greenfield exploration drilling outside of the known mineral resource areas totals around 10,000 meters, in contrast to more than 200,000 meters within these resource areas. This initial exploration has identified several gold occurrences and potential mineral growth targets, indicating opportunities for future systematic exploration.

There is potential for additional discoveries within the Três Palmeiras greenstone belt. With large areas still to be explored, the likelihood of finding new mineral resources exists. This situation offers an opportunity for Belo Sun to enhance its exploration efforts and possibly increase its mineral resources.

Project History

From the 1960s to the late 1990s, the Três Palmeiras exploration belt saw extensive mining activity by Garimpeiros (artisanal miners). They employed both open-pit and underground mining techniques. Anecdotal reports from local garimpeiros suggest that the average grade of material extracted from several small alluvial gold deposits reached up to 3 oz/t Au. Furthermore, grab samples from shafts, ranging from 80 to 200 meters deep, previously used by these miners, have shown assays as high as 475 g/t Au.

The 1990s marked the identification of widespread gold mineralization by TVX Gold (acquired by Kinross) and Battle Mountain Exploration (acquired by Newmont). The Project has since seen 200,000 meters of core drilling. In 2003, Belo Sun assumed control of the Três Palmeiras exploration belt.